Objective 1: unemployment

Definition: People of working age who are without work, available for work and actively seeking employment (Start / Retire ages varies by country)

How is it measured and what are the problems

This is specific to each country but some typical "Indicators" include:

- Unemployment insurance/benefits

- Retirement benefits

- Surveys

- Administrative Record

There are two main problems with this:

- People may register for unemployment benefits even if they are unemployed to reap the benefits

- People may be unemployed but not registered for unemployment benefits.

Hidden unemployment

These are people who are considered unemployed even though they are seeking a job, for three main reasons:

-

Over Qualified - They have a job but they are overqualified for that job and are seeking a better one.

-

People Who Gave Up Looking - They wanted a job but it took too long and was too depressing so they gave up.

-

Part time workers - They work part time but they really want to work full time.

Distribution of unemployment

National Unemployment: This is the average unemployment for the whole country, which hides the inequalities which are present among different groups in the economy

Disparities in unemployment

-

Geographical Disparities

-

Age Disparities

-

Ethnic Differences

-

Gender Disparities

Cost of unemployment

| To the unemployed |

To society |

To the whole economy |

- Lower Standards of Living for them and Their Families

- Mental health

- Loss of skills & experience

|

- Poverty

- Homelessness

- Crime

|

- Opportunity cost of the unemployment benefits

- Lower Tax Revenues for the government

- Inequality

|

Inflows and outflows from 'pool' of unemployment

Inflow

- People lost their jobs

- People resigned

- People left school and not found work

- People trying to return to work after left it

- People immigrated to country but not found work

Outflow

- People find job

- People retire

- People go back to education

- People choose to stay home to look after children

- People who emigrate to other countries

- People who give up searching for job

- People who pass away

The Labor Market

ADL: Demand for all labor producing goods and services (ADL depends on AD)

ASL: All willing and able to work at every given price rate

Disequilibrium vs Equilibrium unemployment

Equilibrium unemployment

Employment which occurs naturally due to the changing economic state. This includes:

- Real-Wage (classical)

- Demand deficient

Disequilibrium unemployment

Unemployment caused unnaturally by government intervention. This includes:

- Frictional

- Seasonal

- Structural

Types of Unemployment and causes

|

Type

|

Definition

|

Causes

|

Example(s)

|

|

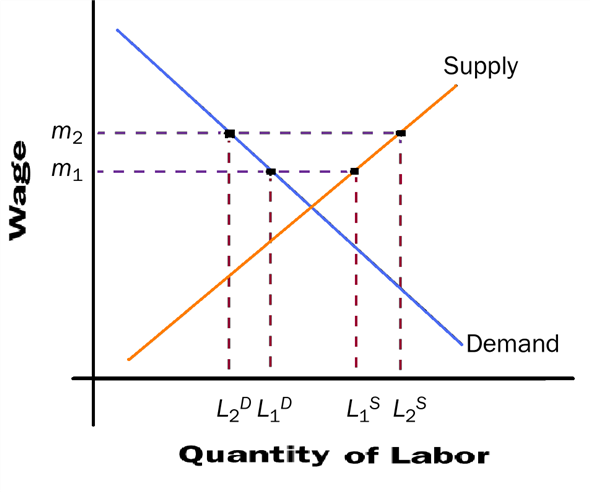

Real-wage (classical)

|

Unemployment caused by a minimum wage

|

The minimum wage is raised, so ASL goes up. But, ADL decreases because firms can't pay the higher wages for the same number of workers. So ASL is higher than ASD.

|

Teacher union demands higher minimum wage for teachers

|

|

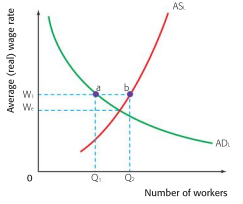

Demand-deficient (cyclical)

|

Not enough demand in the economy for companies to afford to pay employees.

|

In recessions, GDP falls which presents a fall in AD. If consumers are spending less money, companies either don't need as many employees or can't afford to pay them. So AD shifts left.

|

Automobile worker laid off during recession because not as many workers needed to meet demand.

|

|

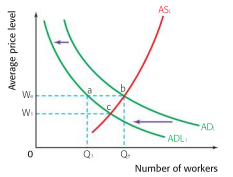

Frictional

|

The natural unemployment associated with being in between jobs

|

Looking for 1st job

Transferring from one job to another

|

Student looking for first job after university

|

|

Seasonal

|

Unemployment associated with seasonal jobs

|

Some jobs mean you can only find work during certain seasons. So during the rest of the year you are unemployed.

|

Ski instructor only works during winter or an ice cream seller who only works in summer

|

|

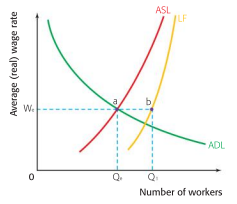

Structural

|

Unemployment, caused by mismatch between skills offered by labour and skills demanded. Long lasting.

|

Caused by shifts in economy such as:

- Change in technology, making the job unnecessary.

- Labour cheaper in foreign countries

- Change in consumer tastes

- Industry relocates and employees are unable to follow.

|

Factory workers laid off because robots can now do their job for them.

Local rice farmers unable to compete with global markets

|

Unemployment diagrams to remember

| Type of unemployment |

Diagram |

|

Real-wage (classical)

|

|

|

Demand-deficient (cyclical)

|

|

|

Frictional and Seasonal

|

|

|

Structural

|

|

Unemployment solutions

|

Type of unemployment

|

Solution

|

Concern with solution

|

|

Real-wage (classical)

|

Remove minimum wages |

Hurts people because they may work but at a salary to low to live.

Contracts will prevent wages from being changed.

|

|

Demand-deficient (cyclical)

|

Increase government spending, Tax incentives, Lower interest rates

|

This can take a very long time. vIt also depends on the economic conditions of the time. A recession take longer to recover from |

|

Frictional

|

Reduce unemployment benefits

Improve communication of information about jobs.

|

Unemployment benefits can be required to live. Without them people may be scared to leave their job to transition to a better one.

|

|

Seasonal

|

Promote education to give more skills to seasonal workers.

Improve transition period.

|

This can require a lot of money which could’ve been better spent elsewhere (opportunity cost).

It also has a time lag, so the results are quite indirect

|

|

Structural

|

Interventionist policies (Direct):

- Tailor education system to improve workforce flexibility

- Retrain adults to be able to switch jobs

- Subsidies or tax breaks to encourage people to relocate.

Market-based policies (Indirect):

- Reduce unemployment benefits

- Deregulation of labour markets

|

Crowding out

When a government runs a budget deficit in order to stimulate the economy and reduce the unemployment, but causes investment to decrease as a consequece

Budget Deficit: The amount by which governments expenditure exceeds government revenue

-

Government borrows money in order to increase spending (AD)

-

Demand for funding increases

-

Interest Rates go up

-

Investment rate goes down (AD)

Does crowding out actually occur?

From keynesian point of view the event will not occur below full employment (the government should do this). However, from the new classical point of view this is a significant problem of increased government spending

Objective 2: A low and stable rate of inflation

Inflation: Persistent increase in the average level of prices

Disinflation: A decrease in the rate of inflation

Costs of Inflation

-

Loss of Purchasing Power

-

Negative Effect on saving

-

Interest rates tend to go up

-

Negative Effects on International Competitiveness

-

Economic Uncertainty

-

Labor Unrest

Deflation

Deflation: Persistent fall in average level of prices in the economy

Good deflation: Deflation due to an improvement in the supply side of the economy and/or increased productivity (increase in LRAS → increase in GDP and a fall in unemployment

Bad Deflation: Deflation due to a fall in AD. Thus a fall in GDP and an increase in unemployment

Cost of deflation

-

Unemployment

-

Reduce Investments

-

Cost of Debtors

-

E.g Borrow $500, 0000 to buy a house, the economy deflates, the house is now worth 400, 000 now people are paying 500, 000 for a house worth 400, 000

How is inflation measured

Consumer price index(CPI)also known as the Retail Price index

This is where they take a basket of goods and calculate the price change of that basket of goods.

- baskets are composed according to consumption habits

- The more common the product the more weighted its value

Issues involved in the measurement of inflation

-

Baskets are based on typical households, so aren't representative of all consumers

-

Regional differences

-

Accuracy

-

Changes in consumption

-

International Comparison is Problematic as different countries use different methods

-

Prices may change for a variety of reasons that are not sustained (seasonal food, holidays)

Note: Yuu can also use producer price index to calculate the change in the price of factors of productions

Demand pull Inflation

This occurs when there is an increase in Aggregate demand in the economy so to supply the higher demanded quantity increases prices are needed.

This is seen when there is:

-

An increase in consumer confidence leads to greater consumption

-

An increase in foreign income leads to an increase in the demand for exports

-

An increase in government spending

Evaluate whether demand pull inflation can occur

New classical and Keynesian disagree on whether demand pull inflation will occur.

| Point of view |

Diagram |

| New classical theory says that increases in aggregate demand is followed by upward pressure on wages and therefore no increase in output in the long run. |

|

|

Keynesian theory says not all increases in in AD result in an increase in prices. If the economy is operating below full employment there is spare capacity and prices won’t have to rise.�

|

|

Cost-Push Inflation

When there is a fall in aggregate supply cost push inflation will occur.

It is always caused by an increase in the price of productions or a disruption in the availability of factors of production, such as in a war or natural disasters.

Solutions to inflation

Contractionary demand side policies, if the inflation is causes by demand-pull, otherwise supply side policies must be used

Demand side policy solutions:

- Monetarist Policies: The money supply and interest rates are both useful. Higher interest rates can slow the demand.

- Fiscal Policies: Governments can also reduce spending and increase tax rates but this take longer to implement.

- Demand Side Policies don’t work if the problem did not start as a demand side problem.

Calculating inflation

Index value: Price of basket in year x Price of basket in base year x 100

Inflation Rate: (Price of basket in year X+1) - (index value in year x) Index value in year x100

Average index: Sum of Housing, Transport Foodstuffs ect.Number of the above items

Phillips curve

Short run phillips curve

This shows the inverse relationship between inflation and unemployment.

It is inversely proportionally because at higher levels of inflation economic growth will be high, so the demand for jobs is also high and unemployment is low.

This is shown in the diagrams below:

Long run phillips curve

In the long run the phillips curve is vertical because if workers are working above their maximum capacity int he long run they will demand higher wages and unemployment will shift back tot heir normal position.

Note: This provides evidence for the new classical model.

Objective 3: Economic growth

This is an increase in real GDP caused by shifts in aggregate demand or aggregate supply. In an economy this is a very important goal because high economic growth can lead to higher standards of living.

Shifts in AD will lead economic growth under certain conditions, and others will not however shifts in AS will always lead to economic growth.

Causes of economic growth

| Cause of economic growth |

Affects inflation? |

Explanation |

Diagram |

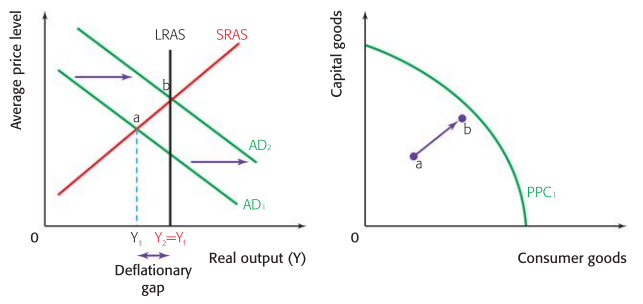

| Shift in aggregate demand |

Yes |

These two diagrams show the same thing. The increase in AD on the left moves the total output closer to the maximum. |

|

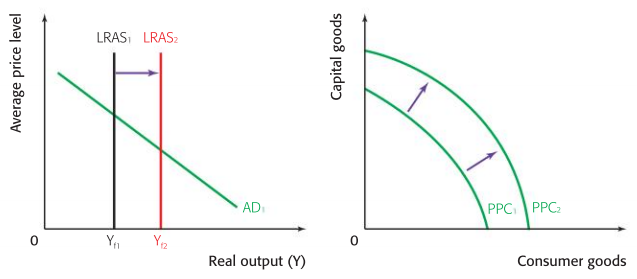

| Increase in production possibilities |

Yes |

More can be supplied with the same workforce, so Aggregate demand moves along the curve and real output increases. On a production possibility curve this is shown by expanding it outwards. |

|

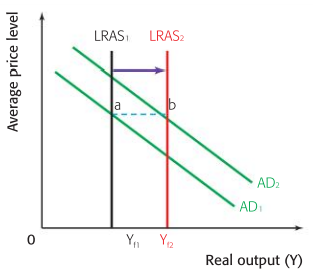

| Shift in aggregate supply and aggregate demand |

No |

Where both LRAS and AD increases to increase output, but average price level stays the same. |

|

Pros and cons of Economic Growth

Pros

-

Likely increase in material standards of living

-

Reduction in unemployment

-

Increase in government revenue

-

Promotes investment

-

Potential technological innovation as a result of investment

-

Improvement in competitiveness of countries exports

Cons

-

Not necessarily an increase in happiness

-

Not necessarily higher incomes for everyone

-

Increase in productivity → Reduction in leisure time

-

Possible Structural Unemployment due to structural changes in economy

-

Negative externalities of production / impact on environment

Objective 4: Equity In the Distribution of income

The meaning of equity in the distribution of income

Equality of income: Everyone in the society receives the same income for their work

Equity of income: Income should be distributed "fairly" within society.

Many think that equity is the same as equality, but in fact they are different things. To have equality of income means that the income is distributed equally in the society. This is the premise of socialism/communism and for a number of reasons it has been shown to not work. So, instead what we aim for is a fair distribution of income. The definition of fair is subjective but in a general sense this means that there shouldn't be a minority earning a lot while the majority of people earn too little.

Why isn't equity possible?

If you look around you, you'll quickly realize that we don't have a fair distribution of money. For example the top 1% of Americans earn 20% of the total income; do you think that is "fair"?

The problem is that those who own the factors of production tend to be the ones who become the most rich and all the rest end up being relatively poor. Employees of businesses far outnumber owners of business yet it is the owners who make the most money. This is a fundamental issue of the market system. Since scarcity gives way to high prices, the owners of the limited number of resources will always be the most rich.

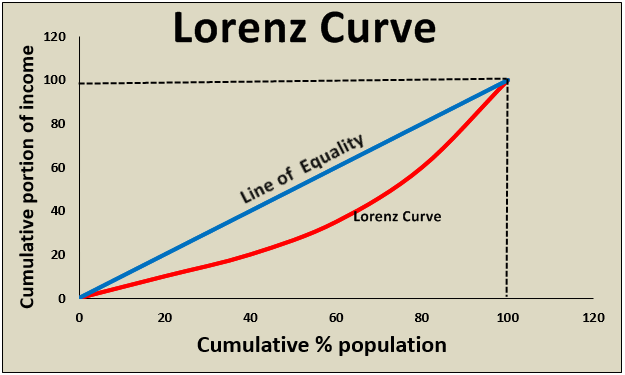

How to measure income equality

You can measure income equality using a Lorenz curve. This is a curve where the cumulative percentage of income is plotted against the corresponding percentage of the population.

The key thing about the lorenz curve is that the amount of income inequality can be seen quickly just by looking at how curved the curve is. If the line is perfectly straight it is called the line of equality as this means that everyone earns exactly the same amount of income and the further the line goes from this line the more unequal the income.

Gini coefficient

The gini coefficient is a percentage which essentially tells you the level of income inequality in the country. With 0 meaning there is full equality and 1 meaning there is full inequality (1 person holds all income). To calculate it you take the area between the line of equality and the lorenz curve and divided it by the area under the line of equality.

Poverty

Absolute vs relative poverty

Absolute poverty: When a household has insufficient income to afford even the basic necessities of life (water,food, shelter)

Relative poverty: When a household receives less than 50% less than the average household income, so they have enough money for the basic necessities but not much more.

Causes of poverty

The main causes of poverty all stem from people not being able to work so they can't earn sufficient income.

- Unemployment

- Globalization: Low income jobs are taken by people in other countries who can do the same work for cheaper, causing unemployment.

- Automation/technology: People unemployed because there jobs are no longer neccessary. They may be unable to find new jobs.

- Inflation

- People's income buys less than it should, so they fall below the poverty line.

- Under-education

- Those who are not educated well, don't have the skills to work and so can't progress in society.

Consequences of poverty

- Lack of access to healthcare and education

- Crime

- low living standards

- Child abuse

Equity and Taxation

Types of Tax

Taxes are money paid by the population to the government. It is agreed by most people that people with higher incomes should pay more tax. There are three different ways to weight tax based upon income.

Progressive tax: This is where the marginal tax rate increases as net income increases. For example, the first 20,000$ you earn, you might only have to pay 10% of that income as tax. However, for the next 20,000$, you earn you may have to pay 15% of that as tax. This is considered by many as the most effective form of tax because the government can collect money without depriving poor people, but at the same time gathering large amounts from rich people. This means they can invest in public education and other things with reduced risk of crowding out. However, a negative this reduces the incentive for richer people to stay in the country.

Proportional tax: This is where the marginal tax rate doesn't change as net income increases. For example, the first 20,000$ you make, you will be taxed 15% of that money. The next 20,000$, you are also taxed 15% of that money. The issue with this is that the government has to decide on a tax rate that doesn't have a huge impact on lower incomes citizens but still collects enough money from higher-income citizens. The benefit of this is that higher-income earners are less likely to commit crimes like tax theft, and less likely to leave the country.

Regressive tax: This is where the marginal tax rate decreases as net income increases. In most cases, high-income citizens will pay almost the same amount as low-income citizens. This type of tax is useful, however, it is rarely used as a form of direct tax. N

There are two different categories of taxes, direct taxes and indirect taxes.

Indirect taxes: Indirect taxes are taxes levied upon expenditure. For example, when you buy a cigarette in most countries, you have to pay the price of the cigarette, and you have to pay more in tax. This tax creates a loss of welfare, and both the consumers and producers have to pay the burden. Additionally, it is regressive, which means that those of lower-income are affected more than those of a high income. Therefore, most goods and services aren't taxed. Instead, direct taxes are used to prevent the overconsumption of demerit goods.

Direct taxes: Direct taxes are taxes levied upon income. In (almost) every country, for every penny you make, you have to pay some amount of money to the government. This type of tax can be either progressive, proportional or regressive.

How do these taxes create equity?

The money collected by the government through taxes isn't (usually) kept by the government, but it is reinvested in the economy. It is spent on things that everyone benefits equally from, such as education and healthcare. Some of this money is spent (in most countries) in the military. It is also invested in the private sector, in order to stabilise the economy. In general investments in things like education and healthcare benefit lower-income citizens more, because they are less likely to have the money to invest in private education or medicine. Therefore, those of low income have more access to these things creating equity.

Since everyone benefits equally from these investments by the government, but higher-income earners (usually) pay more than lower-income earners, there is a redistribution of money from the rich to the poor, also creating equity.

Other measures to promote equity

Government expenditure on social-desirables goods and services

Socially desirable goods are goods which benefit society and the consumer through their consumption. Examples of such goods are:

- health care services

- Education

- Infrastructure

- Sanitation

- Clean water supplies

Unfortunately in a pure free market the price of these goods would be determined by supply and demand and since demand is very high, the price would also be very high. (Like air in the movie "Lorax") This is bad news for low income families because with this system they would not be able to afford these goods and services and miss out on the extensive benefits they bring. This is not "fair" and thus in order to have greater equity in the distribution of income the government undertake expenditures in order to directly provide or subsidise these goods.

Transfer payments

Transfer payments: payments made by the government as gift or aid and not for good or service.

This improves income equality because it helps support the low-income earners financially so they can use the money to spend on consumption. These are the different types:

- Old age pensions - After finishing work, many people do not have a private pension and so will no longer have any source of income. To help with this the government provides their own pension using money from income tax.

- Unemployment benefits - If you lose your job and are unemployed you will no longer have a source of income. Unemployment benefits are payments made to the unemployed to provide this income until they regain their job.

- Child allowances - For low income-families raising children is difficult and often these children are impoverished or under-supported. To help with this the government can pay child allowances to these families, which helps provide school meals and gives an increased income.

The relationship between equity and efficiency

Having greater equity comes at a cost, because it requires intervention into the market system. Any time the government intervenes into the market system there is going to be inefficiency as there is no longer allocative efficiency.

- Disadvantages of taxation - This creates a loss of welfare in the market and disincentivizes higher-income earners from working, as they lose so much to tax.

- Government expenditure - Providing socially-desirable goods to the public costs the government money which increases their budget deficit and public debt. This results in an opportunity cost. There is also inefficiency in the allocation of these goods due to the lack of a profit target.

- Transfer payments - many believe that these payments give people a way to not have to work as they can live off the hard earned money of those who do work. it is also difficult to determine if someone actually needs the transfer payments or are just abusing the system

Editors- Nhf1185 - 1448 words.

- joeClinton - 2062 words.

View count: 24495